Agriculture is one of the major sectors of Bangladesh. The performance of this sector has an overwhelming impact on major macroeconomic objectives.

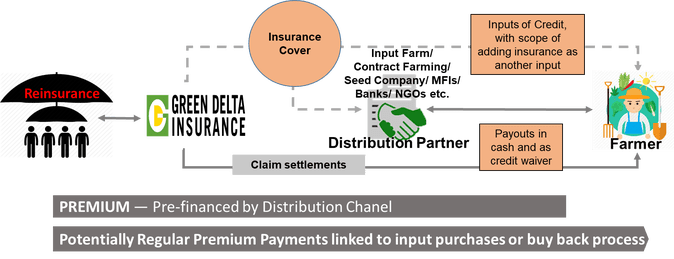

Green Delta aims to serve this huge population through providing insurance to the farmers and work as a stabilizer in the financial condition of the farmers, the agri-lenders and the whole economy of Bangladesh.

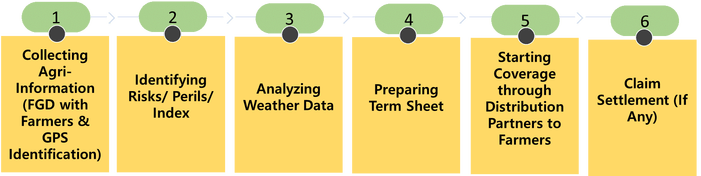

Green Delta Insurance PLC had its first footstep in the agriculture sector jointly with International Finance Corporation (IFC), in 2015. Weather Index Based Agriculture Insurance is to mitigate the risks faced by farmers during the cultivation process arising from adverse weather condition.

Weather Index Based Agriculture Insurance aims to mitigate risks arising from different climate changes and natural disasters, which are faced by farmers and agri-lenders.

The whole idea of Weather Index Based Agriculture Insurance is quite new to Bangladesh and incorporating such high-end modern technology in this sort of product to eradicate risks to provide a financial backup to the farmers is also a noble and dynamic idea. Green Delta Insurance PLC has given these ideas a practical platform while achieving success through several milestones.

GDIC has developed and deployed Agriculture Insurance in Bangladesh to address weather-related risks faced by both lenders and farmers of the country. It will also strengthen technical and financial capability to administer the insurance products that will eventually help to remove the constraints of credit expansion to farmers with the vision to mitigate the weather related risk faced by agri-stakeholders and individual farmers arising from adverse natural calamities and climate change incidents like drought, excess rainfall, cold waves, cyclone signals, high or low temperature etc.

Our success is ensured for our special features, such as:

Weather Index Based Agriculture Insurance aims to serve the farmers, crop producing farms across Bangladesh. This insurance facility can be availed for a certain premium to insure them in case of financial risks and damages incurred to production of crops due to weather changes.

“Each client will be facilitated through customized or tailored products as per the weather index and historical weather data.”

Weather Index Based Agriculture Insurance coverage as at 31 December, 2018:

Green Delta Insurance PLC(GDIC) is one of the leading private non life insurance companies in Bangladesh. GDIC was incorporated in December 14, 1985 as a public limited company, under the Companies' Act 1913 and its operation started on 1st January 1986, with a paid up capital of BDT 30.00 million.

To apply please fill out this form!